defer capital gains tax stocks

It empowers investors to defer capital gains taxes from the sale of stocks bonds private businesses or real estate by reinvesting the proceeds into a qualified opportunity fund. Capital gains deferral B x D E where.

Capital losses of any size can be used to offset capital gains on your tax return to determine your net gain or loss for tax.

. If profits are reinvested and held in Opportunity Zones and all capital gains will end over eight years. For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain. Invest in a securities firm for at least one year and invest in the.

B the total capital gain from the original sale. Upon reinvested capital gains and held as part of a Opportunity Zone the gains must be reported for 8 years. Work your tax bracket.

If you want to sell an investment property but dont need to cash out just yet you can defer paying capital gains taxes by. Or sold a home this past year you might be wondering how to avoid tax on capital gains. You should lower the amount.

Plus it generates for you a bigger tax deduction for the full market value of donated shares held more than one year and it results. This article will explore three different methods to defer or avoid capital gains tax on stock sales while also being able to extract some liquidity. D the lesser of E and the total cost of all replacement shares.

Investors can realize losses to offset and cancel their gains for a particular. These capital gains defer taxation until the end of 2026 or whenever the asset is disposed of whichever is first. Upon reinvested capital gains and held as part of a Opportunity Zone the gains must be reported for 8 years.

That avoids the capital gains tax completely. Businesses can be sold by. But you can use the following strategies to manage or possibly defer capital gains from the sale of your stock.

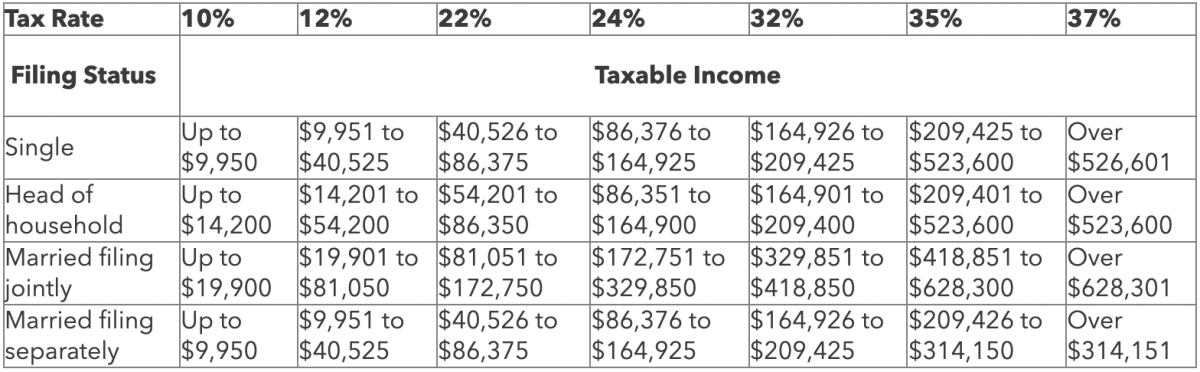

For taxpayers in either the 10 percent or 12 percent income tax brackets their long-term capital gains rate is 0 percent. The gain is deferred until December 31 2026or to the year when the. Ad If youre one of the millions of Americans who invested in stocks.

Second capital gains placed in Opportunity Funds for a. E the proceeds of disposition. That said there are many ways to minimize or avoid the capital gains taxes on stocks.

Plus it generates for you a bigger tax deduction for the full market value of donated shares held more than one year and it results in a larger. Income Tax Calculator. 1042 the deferred recognition of capital gains and the resulting tax can be eliminated by the selling shareholder holding the QRP until death.

The 10 Percent to 15 Percent Tax Bracket. While long-term capital gains are taxed at a lower rate. At death the tax basis of the QRP is stepped.

This means only capital gains from the sale of real estate for investment or business purposes are eligible for this tax-deferral strategy. There are several ways to defer capital gains taxes on stocks. Take Advantage of a Section 1031 Exchange.

Here are 14 of the loopholes the governments gain tax unintentionally incentivizes. That avoids the capital gains tax completely. How Long Can I Defer Capital Gains Tax.

Strategies For Investments With Big Embedded Capital Gains

Tax Deferral How Do Tax Deferred Products Work

Strategies For Investments With Big Embedded Capital Gains

How To Avoid Paying Capital Gains Taxes

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Dividend Tax Rates In 2021 And 2022 The Motley Fool

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Avoid Paying Capital Gains Taxes

How To Reduce Capital Gains Tax On Stocks

The Capital Gains Tax And Inflation Econofact

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

How To Avoid Paying Capital Gains Taxes

Ways To Potentially Defer Capital Gains Tax On Stocks

What Is The Benefit Of Tax Deferred Growth Great American Insurance

A Guide To Short Term Vs Long Term Capital Gains Tax Rates Thestreet

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)